Forex trading leverage is a powerful tool that allows traders to control large positions with a relatively small amount of capital. Understanding how leverage works is crucial for anyone looking to enter the foreign exchange markets. In this article, we will explore the concept of leverage, its benefits, risks, and how to effectively apply it in your trading strategies. If you’re interested in Forex trading, be sure to check out forex trading leverage explained https://webglobaltrading.com/ for more resources and information.

What is Forex Trading Leverage?

Leverage in Forex trading refers to the ability to control a larger position in the market using a smaller amount of capital. Essentially, it is a loan provided by your broker to amplify your potential returns. For instance, if your broker offers a leverage ratio of 100:1, you can control a position worth $100,000 with just $1,000 of your own capital. This means you can increase your market exposure significantly without having to commit an equivalent amount of cash upfront.

How Leverage Works in Forex Trading

To put it in perspective, let’s consider an example. Suppose you have an account balance of $1,000 and your broker offers you a leverage of 50:1. This means you can control up to $50,000 in trades.

- If you decide to buy 1 standard lot of EUR/USD, you would typically need $10,000 in your account to open that trade without leverage. However, with 50:1 leverage, you only need $200 in margin to open the same position.

- Now, let’s say the price of EUR/USD increases from 1.1000 to 1.1050. You make a profit of 50 pips. With 1 standard lot, this translates to a profit of $500. Without leverage, a $50 profit would have required an investment of $10,000!

Benefits of Using Leverage in Forex Trading

There are several benefits associated with using leverage in Forex trading:

- Increased Potential Returns: Leverage allows you to increase your potential profits without needing to invest a large amount of capital upfront. As demonstrated in the example above, small movements in currency prices can lead to substantial returns.

- Access to Larger Positions: Leverage enables traders to take larger positions in the market than they would otherwise be able to afford. This can enhance portfolio diversity and enable participation in more substantial trades.

- Flexibility and Opportunities: With leverage, traders have more flexibility in terms of capital allocation. They can take advantage of various trading opportunities without tying up significant amounts of money.

Risks of Using Leverage in Forex Trading

While leverage can amplify profits, it also magnifies risks:

- Increased Losses: Just as leverage can increase profits, it can also escalate losses. A small adverse movement in the market can lead to significant losses, potentially exceeding your initial investment.

- Margin Calls: If the value of your account falls below the required margin level, your broker may issue a margin call, requiring you to deposit additional funds to maintain your position or close it at a loss.

- Psychological Pressure: Trading with leverage can create additional stress for traders as the stakes are higher. Emotional decision-making can lead to mistakes and further losses.

How to Use Leverage Effectively

To navigate the complexities of leverage in Forex trading successfully, consider the following strategies:

- Use Appropriate Leverage: Select a leverage ratio that aligns with your risk tolerance and trading strategy. Not all traders need to use maximum leverage. Sometimes, lower leverage can be more effective in managing risk.

- Implement Stop-Loss Orders: Protect yourself from significant losses by using stop-loss orders. This helps limit the amount of money you stand to lose on a trade, regardless of leverage.

- Diversify Your Trades: Spread your investments across various currency pairs instead of putting all your capital into one position. This can help mitigate the risks associated with leverage.

- Education and Practice: Invest time in learning about the Forex market and practice trading strategies in a demo account before using real capital. This way, you can understand how leverage impacts your trades without risking your money.

Regulatory Considerations and Broker Selection

Different countries have varying regulations regarding Forex trading leverage. For example, many regulators in Europe set leverage limits to protect retail traders from excessive risk. It’s essential to be aware of your local regulations and choose a broker that operates under the guidelines of reputable regulatory bodies.

When selecting a broker, consider the following factors:

- Leverage Offered: Ensure the broker provides leverage ratios that suit your trading strategy.

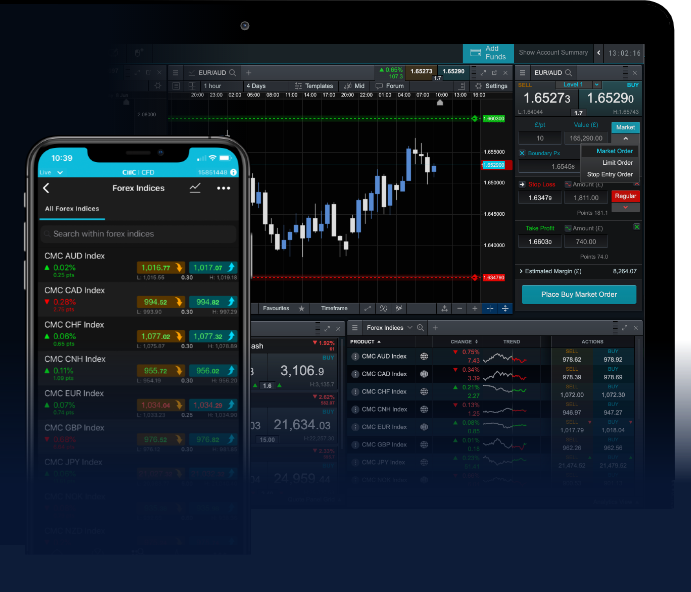

- Trading Platform: Choose a broker with a reliable and user-friendly trading platform that supports your trading style.

- Customer Support: Good customer service can help you navigate issues quickly, particularly during high-stress trading periods.

Conclusion

In conclusion, while leverage can enhance your trading capabilities in Forex markets, it’s crucial to understand both its potential benefits and risks. Effective risk management practices, thorough education, and prudent broker selection are key components to leveraging your trading success. By approaching Forex trading with the right knowledge and strategies, you can harness the power of leverage to achieve your trading goals.